12 June 2025

Savannah Resources Plc

(AIM: SAV) ('Savannah', or the 'Company')

Strong Progress maintained towards the Development of the Barroso Lithium Project

Savannah Resources plc, the developer of the Barroso Lithium Project (the 'Project') in Portugal, one of the European Commission's 'Strategic Projects' under the Critical Raw Materials Act and Europe's largest spodumene lithium deposit, is pleased to provide an update on a number of ongoing Project workstreams. The Company continues to make good progress towards completion of the Definitive Feasibility Study ('DFS') and licencing phase in the Project's overall development into a key asset in Europe's lithium battery value chain.

Highlights (Early April to date):

· Definitive Feasibility Study

o Drilling: Good progress continues to be made with the phase 2 drilling programme, with multiple drill rigs working in parallel across the Project. As at 6 June, 93 holes have been drilled for approximately 11,400m in the planned 117/c.13,000m programme.

o Assay results: Results have now been received from 68 holes drilled across the Pinheiro, Reservatório and Grandão orebodies. The latest (third) batch of assays (see 29 May 2025 RNS for full details) included 43m @1.24% Li2O from 15m at Pinheiro, 38m @1.67% Li2O from 41m at Reservatório, and 7m @1.38% Li2O at Grandão.

o JORC Resource updates: Assays to date indicate the potential for grade and tonnage increases at Pinheiro and tonnage increases at Reservatório. As the first orebody to be mined any increase in Pinheiro's average grade and size could have a positive impact on operating costs and cash flow generation in the Project's first years. JORC Resource updates for these orebodies and Grandão will be made as part of the DFS programme later this year.

o Other workstreams: Work on all other fronts, including mine scheduling, metallurgical testwork, surface and ground water modelling, processing plant equipment engineering and CAPEX estimation, tailings and water storage, hydrogeology, decarbonisation, by-product strategy and road network design, is proceeding as scheduled.

· Environmental Licencing: Field studies and preparation works for Savannah's 'RECAPE' submission continued during the period.

· Infrastructure: The Environmental Impact Assessment and accompanying Preliminary Design report for the 16km bypass road was submitted to the Portuguese Environmental Agency in April. In parallel, the Project's technical report was submitted to Infrastruturas De Portugal (IP). Preliminary design work on the internal haul roads between the processing plant and mining areas was advanced and is nearing completion.

· Land ownership and access: Savannah is proceeding with its plan to secure ownership of, or access to, all the land required for the Project's development. Three separate workstreams are currently underway; the ongoing acquisition of land on commercial terms, securing a second land easement (temporary access order) in support of future fieldwork, and the legal process through which the Company can compulsory acquire/access the properties that it has not been able to acquire or access to date. On the second land easement, relevant property owners have already been notified by the relevant authorities and an approval is expected shortly.

· Stakeholder engagement: Savannah has continued to deepen its engagement with local stakeholders through targeted outreach, enhanced presence in the field, and strengthened two-way communication channels. During the period, Savannah conducted a second trip to a mining area for our local community, taking a group to meet the Barruecopardo community located near to Saloro S.L's operating tungsten mine in Salamanca province, Spain.

· Recruitment: Recent hires include Henrique Freire to the role of Chief Financial Officer ('CFO'), Egídio Ribeiro as Project Finance Manager and Mike Tamlin as Offtake Adviser. Michael McGarty, the Company's former CFO took up a newly created role as Chief Corporate Officer.

· Next Steps: During the remainder of Q2 and Q3 2025, Savannah will continue to advance all DFS and environmental licence-related workstreams. The Company will also continue with its stakeholder engagement activities, team expansion and with its efforts to secure ownership or access to all Project-related land.

Savannah's Chief Executive Officer, Emanuel Proença said, "There has been more good progress with the Project's development over the past two months and the team, which continues to grow in parallel with our progress, have pushed hard to ensure we complete key tasks to reach the next set of milestones. As we have flagged, the ongoing drilling campaign continues to return exciting results and we are all looking forward to seeing what positive impact this will have on the Project's JORC Resources when the new estimates are made later in the year. Of particular interest is Pinheiro, as the first orebody to be mined, any increase to its average grade and size could have a positive impact on Project's economics through lower operating costs and higher cashflow in the early years.

"Furthermore, our position in the local community is constantly strengthened by our ongoing engagement and ever growing commitment to the area through further job creation and deepening ties with individuals, businesses and community groups.

"Much progress has been made on the Project, but there is much work still to do to reach our next milestones of the Definitive Feasibility Study and final environmental licence. Hence, we expect to generate significant news flow in the second half of the year as we progress towards those goals.

Further Information

Definitive Feasibility Study

The DFS is the detailed analysis of the technical, commercial and economic feasibility of the Project. Recent progress on DFS-related matters includes:

· Drilling Programme: The second phase of drilling required to complete updates on the Project's JORC compliant Resource as well as gathering outstanding geotechnical and hydrogeological data continues to progress well with multiple drill rigs (diamond core and reverse circulation) working across the Pinheiro, Reservatório and Grandão deposits. As of 4 June, a total of 93 holes have been drilled for approximately 11,400m. Hence, Savannah has completed over 85% of the planned 13,000m programme.

Figure 1. Barroso Lithium Project summary map showing deposits and drill hole locations.

· Significant intercepts and assays to date: Savannah has now received assay results from 68 of the holes drilled across Pinheiro, Reservatório and Grandão. The latest (third) batch of assay were reported late last month (see 29 May 2025 RNS for full details) from a further 26 holes (3 at Pinheiro, 21 at Reservatório and 2 at Grandão). Highlights included:

o At Pinheiro, where we continue to intersect broad zones of higher-grade lithium mineralisation both near the surface and at depth on a routine basis, assays included 43m @1.24% Li2O from 15m in hole 25PNRRC034, including 5m @1.93% Li2O. There was also an approximate 70m of near continuous mineralisation in hole 25PNRDD015 consisting of 19m @1.25% Li2O from 50m, including 8m @1.73% Li2O, and 47m @1.29% Li2O from 73m including 9.2m @1.81% Li2O.

Figure 2. Recent drilling at Pinheiro

o At Reservatório, results continue to give very encouraging indications of multiple zones of higher-grade mineralisation. Latest assays included, 38m @1.67% Li2O from 41m in hole 25RESRC070, including 6m @2.17% Li2O and 34.91m @1.24% Li2O from 99m in hole 25RESRC054 (includes 23.1m @ 1.28% Li20 from 99m previously reported from RC drilling).

o The most recent assays from Grandão also confirmed that mineralisation continues along strike and down dip with results including, 7m @1.38% Li2O from 65m in hole 25GRARC144, including 4m @1.5% Li2O and 4m @1.03% Li2O from 23m and 11m @0.97% Li2O from 30m in hole 24GRARC147.

· Potential impact on upcoming JORC Resource updates: Based on the consistent higher-grade zones of lithium mineralisation at Pinheiro combined with very good widths, the potential exists for an increase in the size of the Pinheiro resource and overall grade (last estimated at 2.0Mt at 1.0% Li2O, Inferred). The recent batch of drilling results from Reservatório is also very encouraging with results suggesting there is potential to extend the resource further to the northeast.

· Future assays results: Samples from the remaining 23 holes drilled to date are being processed at the laboratory and Savannah expects to receive the next set of results during Q3 2025. Once reviewed and evaluated Savannah will announce relevant results in due course.

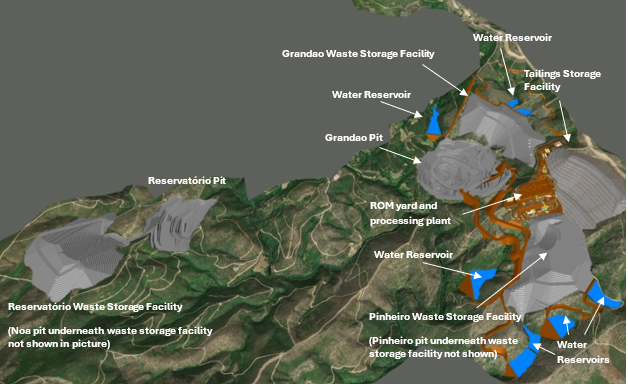

· Site layout: The site layout is complete, with preliminary layout of the roads and infrastructure finalised for the DFS and RECAPE.

· Mining: Life Of Mine scheduling work is completed to a level of detail sufficient to obtain the required data on mining, drilling and explosive volumes, as well as ex-pit haulage profiles and cycles, to be used as a basis to start preliminary market pricing exploration with potential contractors. Contractor pricing requests will be sent out in the coming weeks.

· Processing Plant: Budget quotation requests responses have been received from the majority of contractors engaged with, including for electrical equipment, steel/pipe fabrication and installation contracts. Based on the quotations received, Savannah continues to work with its consultant (Sedgman) to finalise the estimate for the processing plant CAPEX.

· Metallurgical testwork: the initial phase of the programme is nearing completion. Samples from Pinheiro to complete the remaining phase have been received at the laboratory (Nagrom) in Australia.

· Tailings and Water Storage: water reservoirs and site water management designs are largely completed and under review in coordination with our consultants (Knight Piésold and Quadrante Global), to ensure the design satisfies Portuguese standards. The preliminary design of the Tailings Storage Facility is completed, with validation of the final definitive design expected once ground geotechnical information is available after the execution of the field investigation works.

· Hydrogeology: the preliminary hydrogeological model received from Knight Piésold has been reviewed by Savannah and the final report is expected imminently.

· Ceramics by-products: the Company continues its engagement with entities in the ceramics sector to explore business or partnership opportunities in relation to its quartz-feldspar by-products.

Figure 3. Barroso Lithium Project 3D Model

Environmental Licencing

Field studies and RECAPE preparation works continued during the period. Much recent work has focused on biodiversity including:

· Iberian wolf: The 2024 monitoring results continue to support the conclusion that there is no established wolf pack within the Project area, which appears to be used solely as a dispersal or transit zone by individual wolves. However, Savannah has made targeted adaptations to the Iberian wolf monitoring plan with the aim of achieving a more representative and comprehensive coverage of the area. These adaptations are reflected not only in an increased number of transects conducted, but also in the strategic deployment of camera traps (wildlife cameras) and 'Audiomoth' devices (to detect howling).

· Flora & Fauna: The final round of seasonal surveys will take place during June and will serve to update and complement the dataset collected during the 2024 monitoring campaign.

· Forest Inventory: As established in the Project framework and following the completion of the Project's definitive spatial footprint, a forest inventory is scheduled to be carried out during June. This inventory will involve the systematic quantification and characterisation of forested areas directly affected by the development of the Project. The process will adhere to standardised methodologies to ensure consistency, accuracy, and regulatory compliance, taking into account key parameters such as land cover type, vegetation structure, and forest composition. The results of this inventory will provide a robust basis for determining the precise extent of forested land impacted by the Project's implementation. Based on the data collected, a detailed calculation will subsequently be performed to define the corresponding area of forest that will require compensation, in alignment with applicable environmental mitigation policies and national regulatory frameworks. This compensatory area will be established in the coming weeks, ensuring that the Project's environmental obligations are fulfilled in a transparent, measurable, and verifiable manner.

Figure 4. Collection of water data from boreholes in April

Infrastructure

The studies and design work for the Project's supporting infrastructure are now well advanced, with excellent progress made on several fronts including:

· Bypass Road: The bypass will join to the west with the national road R311 to subsequently link to the Project's proposed northern access road, and to the east with the A24 motorway that provides access to the Inner North Freeway, towards the main Atlantic port facilities. As planned, the Environmental Impact Assessment ('EIA') and accompanying Preliminary Design ('PD') report for the 16km bypass road was submitted to Agência Portuguesa do Ambiente, ('APA'), the Portuguese Environmental Agency. In Parallel, the road's technical report was submitted to Infrastruturas De Portugal (IP). A Project presentation session with all relevant stakeholders from Portuguese governmental agencies was held in May.

Following the submission of the bypass road EIA, and considering that the entirety of the baseline study was conducted during the autumn and winter months, an additional biodiversity field campaign was carried out during the Spring season. This additional field effort was specifically designed to enhance the comprehensiveness and temporal representativeness of the biodiversity dataset associated with the Project area. Spring biodiversity surveys hold particular ecological importance, as this season typically corresponds to peak biological activity across multiple taxonomic groups.

The data collected during the spring campaign will serve to refine and complement the existing biodiversity baseline, ensuring a more robust and ecologically representative foundation for impact prediction, mitigation planning, and regulatory compliance. The results of this supplementary campaign will be formally submitted to APA, as part of the ongoing engagement and environmental licensing process.

· Internal haul roads: Preliminary design work on the internal haul roads between the processing plant and mining areas was advanced and is nearing completion.

· Infrastructure geotechnical studies: Preparations are being made for the geotechnical fieldwork required on the Project's infrastructure locations, including internal roads and the northern access road to allow for a swift start as soon as the second land easement (see Land section) is approved by the Portuguese regulator.

· HV Power: The DFS level design and permitting process are continuing, with the design to be submitted to the network operator (E-REDES) during June.

Figure 5. Map showing the potential layout of Project-related road and power infrastructure

Land

· Land acquisitions: Savannah remains open to acquire land plots on amicable terms from local community members and offers significantly better financial terms to the owners than alternative options. Further negotiations are underway, which Savannah expects to be converted into acquisitions in the short term.

· Additional land easement: In support of the fieldwork and geotechnical studies required for the detailed design of the Project's infrastructure, a second land easement application has been submitted to the Government. Relevant property owners have already been notified by the competent authorities and an approval is expected shortly.

· Compulsory land acquisition process: During the period Savannah executed its first 'friendly expropriations', i.e., land purchases in cases where owners accepted to sell their properties after receiving the expropriation notifications. The Company continues to expect approval of a 'Declaração de Utilidade Publica' (Declaration of Public Utility ('DPU')) from the relevant governmental authorities following the application which was submitted in December 2024. This is the mechanism that grants public utility which is necessary for compulsory acquisitions. Once approved, the DPU will allow the Company to compulsorily acquire the properties that it has not been able to acquire to date through its ongoing land acquisition programme.

Recruitment

Savannah is committed to attracting and retaining the best talent in the industry. We believe that our people are the foundation of our success, and we continue to invest in building a team that drives innovation, excellence, and sustainable growth. As part of this ongoing effort, we were pleased to welcome two key additions to our leadership team:

· Chief Financial Officer ('CFO'): Henrique Freire, a seasoned executive with extensive experience in financial leadership across diverse sectors was appointed to the role in April. Prior to joining Savannah, Henrique spent nine years as CFO of US$2bn listed energy entity, EDP Brazil and 13-years in M&A, having served as a Partner in one of the 'Big Four' accountancy firms. This strategic hire reinforces Savannah's focus on strong governance, financial discipline, and long-term value creation. Former Group CFO, Michael McGarty, assumed the new role of Chief Corporate Officer.

· Project Finance Manager: Egídio Ribeiro was appointed as Project Finance Manager. A former investment banker, Egídio's previous role to joining Savannah was as Funding Manager at the Portuguese lithium refinery venture, Aurora Lithium. Along with Henrique, Egídio will be leading Savannah's efforts to secure construction financing for the Project.

During the period, Savannah also appointed Mike Tamlin to the role of Offtake Adviser. Mike brings over 20 years of expertise in the lithium industry. In previous roles, Mike has negotiated and managed significant material offtake agreements and identified and developed major international corporate joint venture partnerships in the lithium mining and converting sectors in Australia and internationally.

Further details of these appointments are available in the 14 April 2025 RNS.

Stakeholder Engagement

Over the past two months, Savannah has continued to deepen its engagement with local stakeholders through targeted outreach, enhanced presence in the field, and strengthened two-way communication channels. Key recent actions include:

· Refining stakeholder insights through sentiment mapping by updating the stakeholder database with new data points and generating a heatmap that visualizes evolving community perceptions-enabling the team to tailor messaging and prioritise follow-up with groups expressing heightened concern.

· Deepening dialogue with local leadership and organisations by holding follow-up meetings with the Associação Futuro do Barroso to reaffirm Savannah's openness to constructive dialogue, and convening sessions with the Dornelas and Canedo Parish Presidents and the Mayor of Ribeira de Pena, to inform them of Project developments.

· Facilitating cross-community learning visits, organising and accompanying a 40-person delegation from Covas do Barroso to the Barruecopardo community (Spain), near the Saloro Mine, creating opportunities for local residents to see first hand how a neighbouring operation manages social performance and livelihood integration.

· Expanding local field presence and housing support, continuing to map housing availability in Covas do Barroso and Dornelas to identify suitable accommodations for the Project's advisors, technical teams, and security staff, and engaging directly with landowners and residents to negotiate and finalise amicable agreements for key land access.

· Broadening youth and academic outreach by hosting Environmental Management & Urban Planning students from the University of Manchester for a full presentation on Savannah's community strategy and target milestones, fostering relationships with future professionals and exchanging fresh ideas for responsible engagement.

These efforts have strengthened Savannah's reputation for transparent communication, built trust with institutional and individual stakeholders, and laid the groundwork for continued community integration as the Project advances.

Figure 6. Community trip to the Barruecopardo community/Saloro mine in Spain

Key milestones and expected future news flow during Q2/Q3 2025:

· DFS:

o Completion of current drilling programme with assay results and updates released periodically during the programme.

o New JORC Resource estimates for the Grandão, Reservatório and Pinheiro orebodies.

o Completion of metallurgical testwork programme

o Completion of independent product characterisation and market study for feldspar-quartz by-product.

o Approval of the HV power permitting design and submission of the licencing request to DGEG.

o Commencement of Front End Engineering Design.

· Environmental Licencing: Finalisation of key work streams for RECAPE submission.

· Infrastructure: Completion of geotechnical fieldwork and studies required to finalise the feasibility design of all the Project infrastructure.

· Recruitment: Continuing expansion of the technical team in preparation for the Project's future development.

· Land Access: Complete processes for second land easement in relation to northern access road and section of the Mining Lease, and compulsory purchase of land elsewhere.

· Stakeholder engagement: Ongoing relationship building with all relevant stakeholders through regular engagement, events, community initiatives and comprehensive communications.

Competent Person and Regulatory Information

The information in this announcement that relates to exploration results is based upon information compiled by Mr Dale Ferguson, Technical Director of Savannah Resources Limited. Mr Ferguson is a Member of the Australasian Institute of Mining and Metallurgy (AusIMM) and has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the December 2012 edition of the "Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves" (JORC Code) and a Qualified Person under the AIM Rules for Companies. Mr Ferguson consents to the inclusion in the report of the matters based upon the information in the form and context in which it appears.

The information in this release that relates to Mineral Resources for the NOA deposit is based on information compiled by Mr Shaun Searle who is a Member of the Australasian Institute of Geoscientists. Mr Searle is an employee of Ashmore Advisory Pty Ltd and independent consultant to Savannah Resources Plc. Mr Searle has sufficient experience, which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he has undertaken to qualify as a Competent Person as defined in the 2012 Edition of the 'Australasian Code for the Reporting of Exploration Results, Mineral Resources and Ore Reserves'. Mr Searle consents to the inclusion in this report of the matters based on this information in the form and context in which it appears.

The Information in this report that relates to Mineral Resources and Exploration Targets for the Grandão, Reservatório, Pinheiro and Aldeia deposits is based on information compiled by Mr Paul Payne, a Competent Person who is a Fellow of the Australasian Institute of Mining and Metallurgy. Mr Payne is a full-time employee of Payne Geological Services. Mr Payne has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the "Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves". Mr Payne consents to the inclusion in the report of the matters based on his information in the form and context in which it appears.

Regulatory Information

This Announcement contains inside information for the purposes of the UK version of the market abuse regulation (EU No. 596/2014) as it forms part of United Kingdom domestic law by virtue of the European Union (Withdrawal) Act 2018 ("UK MAR").

Savannah - Enabling Europe's energy transition.

**ENDS**

Follow @SavannahRes on X (Formerly known as Twitter)

Follow Savannah Resources on LinkedIn

Follow Savannah Resources on LinkedIn

For further information please visit www.savannahresources.com or contact:

|

Savannah Resources PLC Emanuel Proença, CEO |

Tel: 44 20 7117 2489

|

|

SP Angel Corporate Finance LLP (Nominated Advisor & Broker) David Hignell/ Charlie Bouverat (Corporate Finance) Grant Barker/Abigail Wayne (Sales & Broking)

|

Tel: 44 20 3470 0470

|

|

Canaccord Genuity Limited (Joint Broker) James Asensio / Charlie Hammond (Corporate Broking) Ben Knott (Sales) |

Tel: 44 20 7523 8000

|

|

Media Relations Savannah Resources: Antonio Neves Costa, Communications Manager |

Tel: 351 962 678 912 |

|

|

|

About Savannah

Savannah Resources is a mineral resource development company and the sole owner of the Barroso Lithium Project (the 'Project') in northern Portugal. The Project is the largest battery grade spodumene lithium resource outlined to date in Europe and was classified as a 'Strategic Project' by the European Commission under the Critical Raw Materials Act in March 2025.

Through the Project, Savannah will help Portugal to play an important role in providing a long-term, locally sourced, lithium raw material supply for Europe's lithium battery value chain. Once in operation the Project will produce enough lithium (contained in c.190,000tpa of spodumene concentrate) for approximately half a million vehicle battery packs per year and hence make a significant contribution towards the European Commission's Critical Raw Material Act goal of a minimum 10% of European endogenous lithium production from 2030.

Savannah is focused on the responsible development and operation of the Barroso Lithium Project so that its impact on the environment is minimised and the socio-economic benefits that it can bring to all its stakeholders are maximised.

The Company is listed and regulated on the London Stock Exchange's Alternative Investment Market (AIM) and trades under the ticker "SAV".

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.